It’s no secret that in every hospital, fierce competition for scarce dollars exists between departments to buy new capital equipment that increases efficiency and improves patient care. In this new dynamic environment, hospital C-Suite executives are placing an increased emphasis on the collaborative process to acquire capital equipment. This process includes:

- Clinicians: To ensure optimal outcome’s that result in improved patient care

- Clinical Engineering: For the development and evaluation of Total Cost of Ownership (TCO) models and safety and minimum downtimes of technology

- Information Technology: For data security, integrity, inter-operability and connectively to the hospitals IT infrastructure

- Supply Chain Management: For contracting and supplier management throughout the value chain.

You know the results, sales cycles are getting longer with an increased number of stakeholders participating in the purchasing process. Access to key personnel is often blocked and restricted depending on the product requested. It has become increasingly difficult to determine the decision making process and who makes the final “yes”. In addition, higher product costs means that your solution will receive additional scrutiny.

You also know that whatever price you quote won’t be accepted on the first pass. It doesn’t matter if you have a GPO agreement or an IDN contract. Those agreed upon contract prices are simply place-holders and are used to open negotiations. This makes for an uncomfortable scenario if you’re the seller because you know there are two truths: first, with hospital consolidation and the increased sharing of resources, the number of capital equipment purchases is declining, however the projects are much larger. Second, purchase price is an arbitrary number unless you can defend it. Supplier’s should be prepared to have an in-depth review on “value” when your solution requires a total cost of ownership (TCO) discussion.

Total Cost of Ownership

Total cost of ownership (TCO) is a financial model used to ensure all associated costs are considered over the life of each asset. Ownership brings purchase costs but it also brings costs for installing, operating, upgrading and maintaining these assets. Hospitals use TCO analysis to support their acquisition and planning decisions. TCO also ensures that procurement gets the best value for their money.

Cost of ownership analysis is a method to uncover, before the purchase, all of the front-end costs in addition to the hidden costs of ownership. Because every equipment purchase is different, what is included in the TCO calculation will vary.

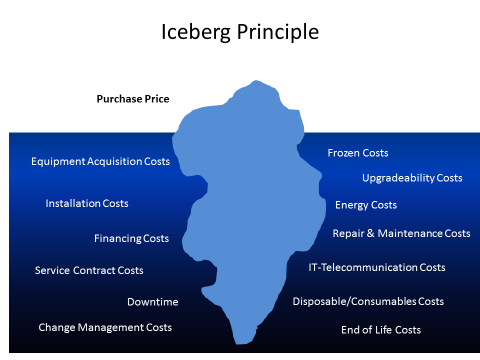

The Iceberg Principle

When it comes to the hospitals cost, your price may only be the tip of the iceberg. Much of their cost may not be obvious because it is hidden below the water line. This is why the Iceberg Principle is so important and is a positive metaphor for sellers. It graphically illustrates the hospital’s hidden costs and benefits by looking at each possible component, carefully and thoroughly. Hidden costs are tangible and can be tracked in financial models.

Shown below is a generic Iceberg Principle example and brief description of some of the hidden costs. Savvy marketers and sellers should collaborate and create their own Iceberg that is specific to their product and industry. This drawing should be shared with the hospital procurement team as it graphically portrays that the fixation on purchase price is not always an accurate financial measurement.

- Equipment Acquisition Costs: The costs of identifying, selecting, ordering, receiving, inventorying and paying for the capital asset.

- Installation Costs: Sometimes capital equipment needs to be installed and this can occasionally require a renovation or remodel. All of these costs need to be captured.

- Financing Costs: This is the cost of capital. For example, loan interest and loan origination fees.

- Frozen Costs: When funds are tied up for equipment purchase they are not available for other uses. This is especially important for hospitals that have limited access to capital (Ex. Critical Access Hospitals).

- Upgradeability Costs: Upgrade fees for software and associated costs.

- IT/Telecommunication Costs: All costs associated with IT support.

- Energy Costs: Hospitals use a plethora of heating, ventilation and air-conditioning (HVAC) compared to other facilities. Does your solution require more or less energy? Any energy savings is welcomed because it provides immediate cost savings.

- Repair & Maintenance Costs: Maintenance costs consist of all the resources needed for maintenance, which may be executed by the hospital itself or by the manufacturer or a third party. The items that have to be paid for include spare parts, service/maintenance engineers, infrastructure and management.

- Service Contract Costs: For some products it makes perfect economic sense for the hospital to purchase a service contract. In other situations, the expense is unnecessary because the hospital’s clinical engineering department has the internal talent and resources to perform the necessary work. Service contracts have to be carefully monitored to avoid costs not included in the contract, coverage levels, exclusions and auto-renewals.

- Downtime: An equipment failure can be expensive for the hospital. It may delay treatment, create a loss of patients or cause an unexpected and unnecessary equipment rental expense. It may also cause unnecessary overtime to be spent. It also creates an administrative expense to coordinate the repair, track the field service and return of the asset to inventory.

- Change Management Costs: User orientation and training along with workflow changes, implementation and monitoring.

- Disposable/Consumables Cost: Consumables are often required to use a particular piece of capital equipment. Oftentimes, the equipment is free or offered at a low price in return for the consumables contract. In addition, hospitals are looking for environmentally sustainable products because energy costs are rising. Sustainability is about improving efficiency and reducing waste. Any packaging that can be reduced in size saves storage space and reduces the cost of disposal. Products that can be reprocessed have an advantage since they reduce waste and disposal cost.

- End of Life Costs: Hospitals frequently struggle with how to efficiently remove equipment at the end of its useful life. If the hospital is replacing old equipment that’s outlived its usefulness, they need to decide to sell it, trade it in, dispose of it or redeploy it. If it’s no longer needed, that old equipment has some salvage value. It may be used as a trade-in or in some cases sold independently. Does the hospital have a proactive approach to end-of-life disposition that maximizes the total return on each asset? If no, perhaps you can help them develop one. Oftentimes, underutilized equipment can be redeployed elsewhere within the hospital or IDN, reducing their total capital spend.

TCO Models

There are many different TCO models. Two of the most common used within healthcare are:

- Life Cycle Costs: This is a cradle to grave financial model

- Cost Breakdown Model: Taking a specific project and breaking it down into components so that every cost can be tracked by work breakdown.

A good unbiased TCO model includes two scenarios: business as usual and the proposed capital investment over a fixed time period (3 or 5 years) based on lifecycle costs. Hospitals use different methods to determine the lifespan of a product.

- Depreciable Life: The number of years over which the asset will be depreciated.

- Economic Life: The number of years in which the acquisition returns more value to the hospital than it costs to own, operate and maintain.

- Service Life: The number of years the asset will actually be in service.

The business as usual scenario recognizes that if the hospital does not acquire the new technology it will spend some money on repairs and maintenance and perhaps incur other hidden costs. By creating a baseline of business as usual versus the proposed capital investment, an analysis can be performed that shows the cost differences between corresponding line items in each scenario.

These should then be compared to the:

- Total Cost of Ownership

- Capital Expense

- Operating Expense

- Net Cash Flow

- Net Present Value

- Internal Rate of Return (IRR)

- Return on Investment (ROI) Payback Period

Advantages of a TCO Model

A good TCO financial model can provide the following benefits to the hospital:

- Define all of the hidden costs of ownership

- Identify all of the potential cost problems in advance

- Allow them to identify areas for costs savings

The Limitations of a TCO Model

No financial model is perfect and TCO is no different. It does, however, provide the best analytical framework for lifecycle cost that we have available today. What are its limitations?

- CFO’s and other hospital procurement team members view the identification and tracking of costs differently. The model must be flexible enough to allow each hospital to modify the data in order to meet their specific needs.

- The model doesn’t account for the inherent risks in buying new equipment. (To understand and mitigate risk, please see our “Lowering The Hospital Buyer’s Risk” eBook.

- The model doesn’t consider the emotional impact that capital equipment incurs when a decision is made to have the latest technology or a specific technology for a new physician.

TCO Also Doesn’t Identify Soft Costs

A TCO model only identifies benefits that have a monetary value (dollars, euros, pounds etc.) Soft savings are realized from not spending money or by saving time or other resources such as:

- Improved clinician or support personnel morale

- Increased patient satisfaction

- Community recognition

Parting Thoughts

Hospitals and other healthcare organizations can save money by looking beyond initial purchase price points by focusing on the hidden costs of equipment performance and improved workforce productivity. Sellers who use the Iceberg Principle to identify and quantify the impact of these hidden costs to the hospital elevate the discussion. This will expand the review of their proposal and create a new heightened level of discussion with hospital procurement and the CFO. Engaging in this process will protect the supplier’s list price and gross margin, and equally important a new strategic partner will emerge. The TCO model must reflect what the hospital values. As always we welcome your thoughts and comments and invitations to connect on LinkedIn.