It used to be easy. Hospitals were where we went for emergency care, certain types of surgeries, for labor and delivery or for in-patient treatment of acute or chronic disease. Hospitals were also easy to find because they had the word “hospital” incorporated with their name.

Under healthcare reform hospitals are reinventing themselves from a fee-for-service payment model to one that pays for performance and that strives to prevent in-patient care through education, prevention and uses of alternate sources of treatment. Their new focus is on health and wellness and the total care of patients whether they are at a clinic, a hospital or at home. As a result hospitals are reinventing themselves. Here are 5 emerging trends that bear careful vigilance if you sell within healthcare.

- Hospital Mega-Mergers

Hardly a month goes by without another hospital mega-merger being announced. The most recent salvo was fired with the announcement that Barnabas Health and Robert Wood Johnson Health System have finalized details of their merger, making the new system the largest in the state of NJ. Combined they will now include 11 hospitals with an annual operating revenue of $4.5 billion and 30,000 employees. If the new entity was a publically traded company they would rank as one of the Fortune 500s largest organizations. As each new health care system is created there is a new executive structure put in place to manage the new larger entity. There is at least one major healthcare system in most major metropolitan areas in the U.S.

Hardly a month goes by without another hospital mega-merger being announced. The most recent salvo was fired with the announcement that Barnabas Health and Robert Wood Johnson Health System have finalized details of their merger, making the new system the largest in the state of NJ. Combined they will now include 11 hospitals with an annual operating revenue of $4.5 billion and 30,000 employees. If the new entity was a publically traded company they would rank as one of the Fortune 500s largest organizations. As each new health care system is created there is a new executive structure put in place to manage the new larger entity. There is at least one major healthcare system in most major metropolitan areas in the U.S.

Why Care? Mega-mergers allow personnel consolidation, increased data sharing, streamlining of services and other economies of scale in addition to reducing local competition for healthcare services. Following a mega-merger almost always two things occurs. First, purchase decisions become more centralized and in many cases are made by a C-Suite team and /or the Vice President of Strategic Sourcing’s department. When this occurs prices usually drop significantly as each hospital compares their individual pricing and sees huge differences and then realizes that with a consolidated purchase commitment they can obtain even greater price reductions. Second, oftentimes, products will be specified and decided upon before department heads and clinicians are involved, or despite their involvement, because the C-Suite will see the price or strategic advantages of working with a particular firm. This is driven by the relationships that evolves between the C-Suite and seasoned Strategic Account Managers that represent the major manufacturers and suppliers.

- Beyond the Hospitals Walls

In the past, hospitals operated hospitals. In today’s world the hospital also owns and operates physician offices and buildings, out-patient surgery centers, sub-acute care providers, rehabilitation centers, skilled nursing facilities, in-patient rehabilitation units and home health agencies to name a few. Their breadth and depth of patient care services is now in-patient, out-patient, diagnostic and wellness. As operators of multi-site, multi-functional facilities they must learn to develop operational efficiencies that provides cost savings, improved patient outcomes and improved satisfaction levels for all constituents using their services.

In the past, hospitals operated hospitals. In today’s world the hospital also owns and operates physician offices and buildings, out-patient surgery centers, sub-acute care providers, rehabilitation centers, skilled nursing facilities, in-patient rehabilitation units and home health agencies to name a few. Their breadth and depth of patient care services is now in-patient, out-patient, diagnostic and wellness. As operators of multi-site, multi-functional facilities they must learn to develop operational efficiencies that provides cost savings, improved patient outcomes and improved satisfaction levels for all constituents using their services.

Why Care? It means that the strategy and structure of a hospital system is evolving at a rapid rate. The decision dynamic of who influences a purchase decision, who is involved in the decision and who is the final yes is getting blurred as new services, personnel and locations are added and as individuals with new responsibilities join the entity and priorities shift.

- Risk Sharing

Make no mistake, risk sharing between device manufacturer’s providers (i.e. hospitals and insurers) is here and it’s gaining momentum because providers don’t want the liability when something goes wrong with an implanted product and it needs to be replaced. Risk sharing is being embraced by the some of the largest companies in the world such as Medtronic, Johnson & Johnson and St. Jude Medical in response to declining sales, the need for competitive differentiation, and increased pressure for evidence based outcomes and risk mitigation from providers and insurers.

As an example: Medtronic is guaranteeing a drop in hospital infection rates for procedures using its Tyrx mesh sleeve that surrounds a cardiac implant with antibiotic. If a hospitals infection rates don’t decrease the company will cover the price of related infection treatments.

Why Care? There are several reasons. If you’re a sales representatives that sells against a firm that offers risk sharing you are going to be at a distinct disadvantage to win the business. If you are lucky enough today to be selling a product that is not involved in risk sharing be thankful but be concerned. It could and probably will become pervasive in the future. Think in of risk sharing in terms of penalties against down-time due to product failures, freight paid for warranty repairs, payment reimbursement for replacement product rentals for recalls or warranty required repairs etc. Hospital Strategic Sourcing is now being operated and staffed by professional buyers.

- Bundling of Payments

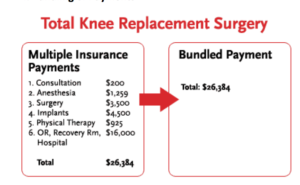

The transition from a fee-for-service reimbursement model to bundled payments is occurring rapidly. Under this scenario patients and insurers are charged one all-inclusive price for everything involved in one episode of care. For example, a hospital performing a hip replacement would receive one payment for the patient’s hospitalization, physician services, physical therapist visits (in-hospital and at home) and home health agency nursing visits.

Why Care? Because hospitals or the insurer are going to use data analytics to thoroughly understand population health, the associated costs for the delivery of care and the outcomes provided to drive decision making. For payers and providers price transparency will be the norm. For many sales professionals their world is going to change markedly. This is especially true for sales representatives that sell into the OR. There will be fewer deals but the ones that are available will be much larger and longer in duration. Win big or go home will become the new reality. Eventually we think bundled payments will affect the majority of manufactures and suppliers.

- The Rep-Less Sales Model

Very few patients that undergo surgery for a hip or knee replacement understand that a sales representative from one of the implant manufacturers is usually in the OR to aid the surgeon and nurses with decisions about the instruments or implant used. While the sales representative provides a valuable service; it is not free. Their service is incorporated into the cost of the implant selected for use with the surgery. This OR sales rep/service model is now under attack by several firms who claim that a rep-less sales model can save hospitals 40% of the implant cost. Smith & Nephew and Microport have responded to the markets request by selling certain of their implants at a significant price reduction, in return for the hospital taking over the responsibilities of the sales representative. One firm, Intralign, makes it easy for the hospital to go rep-less by offering a comprehensive program that replaces the manufacturer’s sales representative with a trained surgical assistant. They bear careful watching.

Very few patients that undergo surgery for a hip or knee replacement understand that a sales representative from one of the implant manufacturers is usually in the OR to aid the surgeon and nurses with decisions about the instruments or implant used. While the sales representative provides a valuable service; it is not free. Their service is incorporated into the cost of the implant selected for use with the surgery. This OR sales rep/service model is now under attack by several firms who claim that a rep-less sales model can save hospitals 40% of the implant cost. Smith & Nephew and Microport have responded to the markets request by selling certain of their implants at a significant price reduction, in return for the hospital taking over the responsibilities of the sales representative. One firm, Intralign, makes it easy for the hospital to go rep-less by offering a comprehensive program that replaces the manufacturer’s sales representative with a trained surgical assistant. They bear careful watching.

Why Care? Every sales representative that’s sells into the OR, wears scrubs and is present during surgery when their products are being used should care. As hospitals are forced to bundle payments they will increasingly scrutinize the purchase price of the implants and associated sales rep services used in orthopedics, spine and other surgeries. They will weigh carefully the financial benefits and render a decision.

One-way manufactures can slow or stop the proliferation of the rep-less sales model is to offer to lower their implant prices and charge for the sales representative’s services as they are needed. Once hospitals see what the charges would be they may change their mind.

Parting Thoughts

Most MedTech manufacturers and suppliers weathered the “sea of change” when DRGs were implemented years ago when many in the healthcare industry predicted that change would cause a dramatic slowdown in hospital purchases. Savvy manufacturers and suppliers will weather these changes with aplomb as long as they are proactive in their realization that these changes are inevitable and they develop a strategy to mitigate them. Change is neither good nor bad. It is how every organization responds to change that determines success or failure.